About Stonewell Bookkeeping

Table of Contents5 Simple Techniques For Stonewell BookkeepingRumored Buzz on Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is DiscussingGetting The Stonewell Bookkeeping To WorkHow Stonewell Bookkeeping can Save You Time, Stress, and Money.

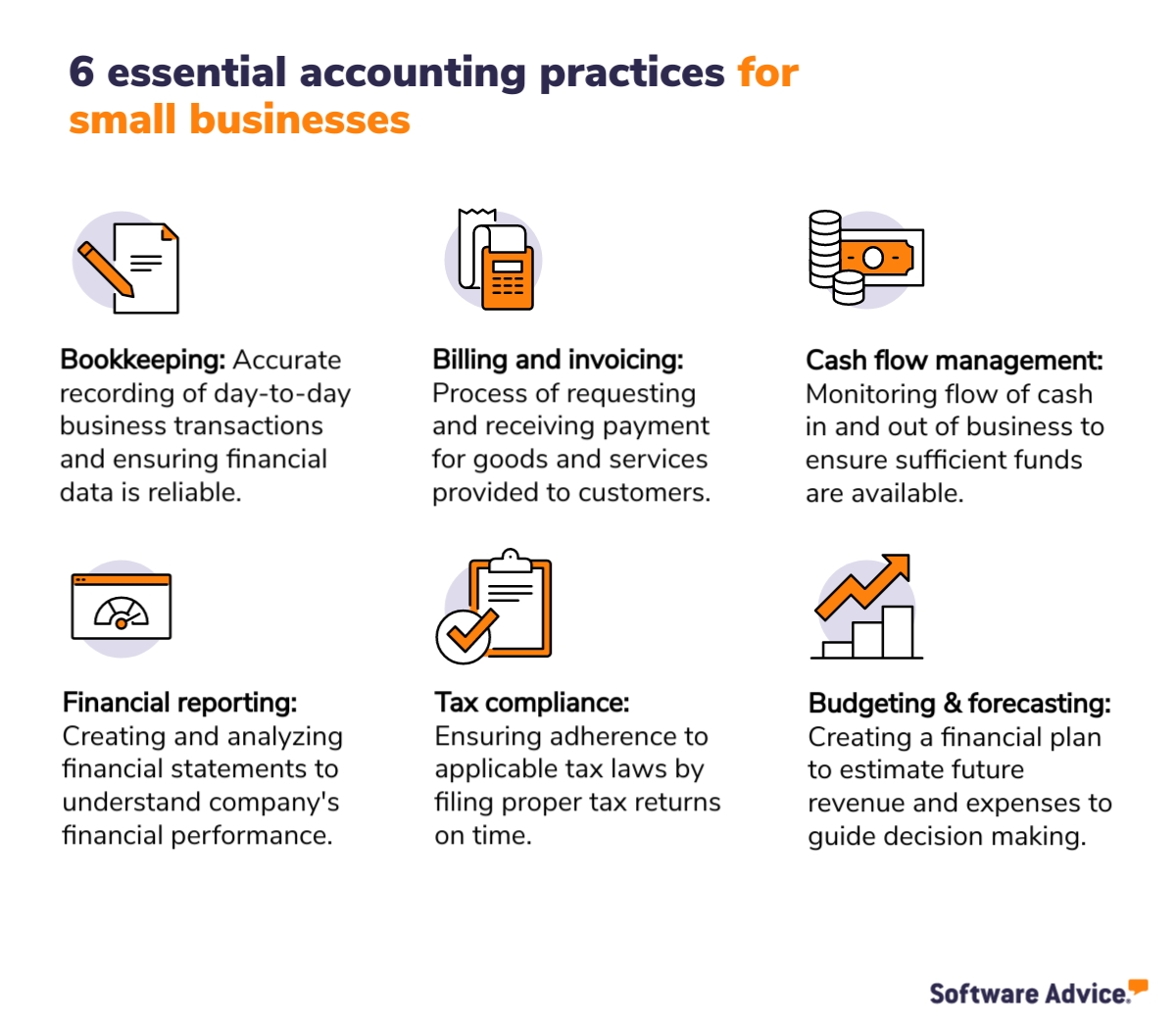

Every business, from handmade fabric makers to game designers to dining establishment chains, gains and spends money. Bookkeepers aid you track all of it. But what do they truly do? It's difficult knowing all the response to this concern if you have actually been solely concentrated on growing your company. You might not fully understand or even start to fully value what a bookkeeper does.The background of accounting days back to the start of business, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers maintained documents on clay tablet computers to maintain accounts of deals in remote cities. In colonial America, a Waste Schedule was commonly utilized in accounting. It contained a daily journal of every purchase in the chronological order.

Local business may depend exclusively on a bookkeeper at initially, but as they expand, having both specialists aboard becomes progressively useful. There are 2 main sorts of accounting: single-entry and double-entry accounting. documents one side of a monetary deal, such as including $100 to your cost account when you make a $100 purchase with your credit card.

The Ultimate Guide To Stonewell Bookkeeping

While low-cost, it's time consuming and prone to mistakes - https://issuu.com/hirestonewell. These systems instantly sync with your credit card networks to give you debt card purchase data in real-time, and immediately code all data around expenses consisting of projects, GL codes, areas, and classifications.

In addition, some accountants additionally assist in maximizing pay-roll and invoice generation for an organization. An effective bookkeeper requires the complying with skills: Precision is key in economic recordkeeping.

They usually begin with a macro perspective, such as an annual report or an earnings and loss statement, and after that drill right into the information. Bookkeepers make sure that supplier and consumer documents are constantly as much as day, also as people and services adjustment. They might likewise require to collaborate with various other divisions to make sure that everybody is utilizing the same data.

The Facts About Stonewell Bookkeeping Revealed

Going into bills into the accountancy system permits for precise preparation and decision-making. This helps organizations get payments much faster and improve cash money circulation.

This aids prevent inconsistencies. Bookkeepers routinely conduct physical stock counts to stay clear of overstating the value of properties. This is a crucial aspect that auditors meticulously examine. Involve inner auditors and compare their matters with the tape-recorded values. Accountants can work as freelancers or internal staff members, and their compensation varies depending upon the nature of their employment.

That being stated,. This variant is affected by variables like place, experience, and ability degree. Freelancers frequently charge by the hour yet may offer flat-rate plans for particular jobs. According to the United States Bureau of Labor Stats, the typical accountant salary in the United States is. Bear in mind that incomes can differ relying on experience, education and learning, location, and market.

The Buzz on Stonewell Bookkeeping

A few of the most usual documents that organizations need to submit to the federal government includesTransaction info Financial statementsTax conformity reportsCash circulation reportsIf your bookkeeping depends on date all year, you can prevent a lots of stress and anxiety during tax obligation season. business tax filing services. Patience and attention to detail are key to better accounting

Seasonality is a component of any kind of task worldwide. For accountants, seasonality indicates periods when payments come flying in through the roofing, where having superior work can come to be a significant blocker. It ends up being critical to anticipate these minutes in advance and to complete any stockpile before the pressure period hits.

See This Report on Stonewell Bookkeeping

Avoiding this will lower the threat of activating an IRS audit as it provides an accurate depiction of your finances. Some usual to maintain your personal and company financial resources separate areUsing an organization bank card for all your business expensesHaving different checking accountsKeeping invoices for personal and company expenses separate Envision a world where your accounting is provided for you.

These combinations are self-serve and need no coding. It can automatically import data such as staff members, projects, classifications, GL codes, view publisher site divisions, task codes, cost codes, taxes, and extra, while exporting costs as expenses, journal entrances, or debt card charges in real-time.

Think about the following pointers: An accountant who has actually worked with companies in your industry will better understand your particular demands. Ask for recommendations or examine on-line reviews to ensure you're hiring someone dependable.